What Is irs printable form w4p?

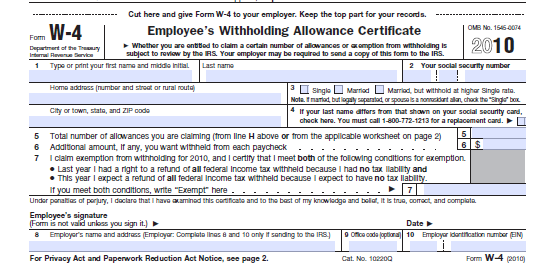

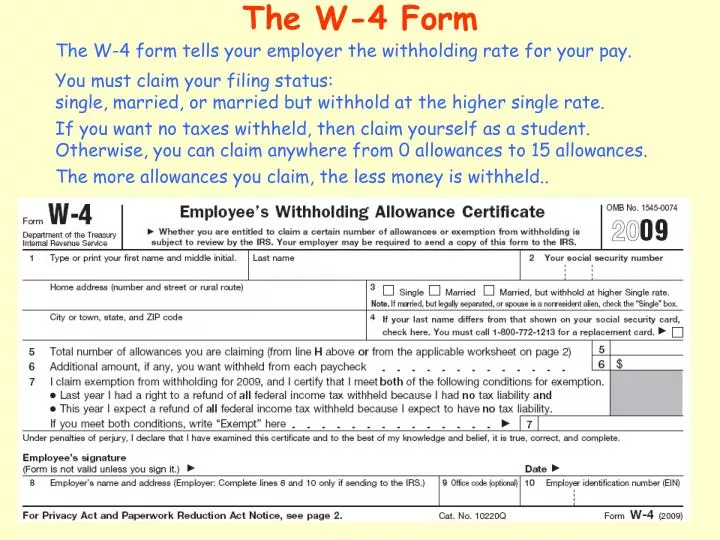

The W-4 form tells the employer the amount of tax to withhold from an employee's paycheck based on their marital status, number of allowances and dependents, and other factors. The W-4 is also. This is because single and married filing jointly taxpayers are subject to different tax brackets. However, the range of income that each bracket covers is different for single and married taxpayers. For example, the 10-percent tax bracket for married taxpayers covers a larger amount of taxable income than for single taxpayers. Highlights - Austin is 0% more densely populated than Dallas. People are 2.9% less likely to be married in Austin. The Median Age is 0.2 years older in Austin.

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. The TCJA has kept this rule in place, but raised the exemption amounts to $109,400 if married filing jointly and $54,700 if married filing separately. Single filers have a higher exemption amount.

Online solutions enable you to to organize your file administration and strengthen the efficiency of the workflow. Follow the short manual so that you can fill out IRS irs printable form w4p?, prevent errors and furnish it in a timely way:

How to complete a w 4p 2019?

On the website hosting the blank, choose Start Now and pass for the editor.

Use the clues to fill out the pertinent fields.

Include your individual data and contact details.

Make absolutely sure you enter true data and numbers in proper fields.

Carefully check out the information in the form as well as grammar and spelling.

Refer to Help section should you have any issues or address our Support team.

Put an electronic signature on the irs printable form w4p? printable with the support of Sign Tool.

Once the form is completed, click Done.

Distribute the ready document by way of email or fax, print it out or download on your gadget.

PDF editor makes it possible for you to make alterations towards your irs printable form w4p? Fill Online from any internet linked device, personalize it according to your requirements, sign it electronically and distribute in different means.

The key difference between single and head of household is that for tax purposes, you can qualify as single if you're single (unmarried, divorced, or, legally separated) whereas you can qualify as head of household if you are single, have a qualifying child or relative living with you, and pay more than half the costs of your home.

An IRS tax filing status is a classification that determines many details about a tax return. There are five filing status as single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child. Single and head of household are two of this status for unmarried or single people.

CONTENTS

1. Overview and Key Difference

2. What Does Head of Household Mean

3. What Does Single Mean

4. Similarities Between Single and Head of Household

5. Side by Side Comparison – Single vs Head of Household in Tabular Form

6. Summary

What Does Head of Household Mean?

Head of Household is a tax filing status most people find confusing. However, it is very important to know about this filing status as it offers many benefits. This is a filing status for single or unmarried taxpayers who keep up a home for a ‘Qualifying Person'. To be more specific, you have to meet the following requirements to file as Head of Household.

- You are unmarried or considered unmarried until the last day of the year (this includes single, divorced, or separated people)

- You have paid more than half the cost of keeping up a home for the year.

- A ‘qualifying person' lived with you at home for more than half the year, except for temporary absences.

A qualifying person is generally a dependent that lives with you. For example, an unmarried and unemployed daughter who lives with you can qualify as a ‘qualifying person'. You can use this link to determine whether the relatives who live with you are qualifying persons or not.

Furthermore, if you want to determine whether you have paid for more than half the cost of keeping up a home, the following are some of the expenses you have to take into account:

- Rent

- Mortgage interest

- Insurance payments

- Utility bills

- Food

- Property taxes

- Repairs and maintenance

- Other household expenses

If you meet the above requirements, you can apply as head of household. As mentioned above, this filing status has many benefits. The tax rate for this filing status is usually lower than the rates for single or married filing separately. Furthermore, this status also receives a higher standard deduction than single or married filing separately statuses.

What Does Single Mean?

Single is the filing status for unmarried people who do not qualify for Head of Household status. You can file your status as single if you were unmarried on the last day of the year, and do not qualify for any other filing status.

For tax purposes, a person's marital status for the entire year is determined by his or her marital status at the end of the year, i.e., December 31st. If you are divorced or legally separated by December 31st, then you are considered to be unmarried for the whole year. However, if you are unmarried, but have a dependent child or a qualifying person, you can file status as Head of Household as it has several benefits over the single status.

What is the Similarity Between Single and Head of Household?

- Single and Head of Household are two IRS tax filing status for single people.

Tax Tables Married Vs Single

What is the Difference Between Single and Head of Household?

Single is an IRS tax filing status for unmarried people who do not qualify for another filing status. In contrast, Head of Household is an IRS tax filing status for single people who have a qualifying child or relative living with them, and pay more than half the costs of their home. These definitions explain the key difference between single and head of household.

Furthermore, the major difference between single and head of household is their requirements. Being single on the last day of the year, and not qualifying for any other filing status are the only two requirements for qualifying as single. But, qualifying as head of household has three main requirements: being unmarried or considered unmarried on the last day of the year, paying more than half the cost of keeping up a home for the year, and having a ‘qualifying person' living at home for more than half the year. Furthermore, the head of household status has many benefits over single status. The tax rate for head of household is lower, and the standard deduction rate is higher when compared to single status. Thus, this is another important difference between single and head of household.

Summary – Single vs Head of Household

W 4 Single Vs Married Rate

Single and Head of Household are two IRS tax filing status for single people. The key difference between single and head of household is that Single is a tax filing status for unmarried people who do not qualify for another filing status while Head of Household is an IRS tax filing status for single people who have a qualifying child or relative living with them, and pay more than half the costs of their home.

Reference:

1. 'Publication 501 (2017), Exemptions, Standard Deduction, and Filing Information.' Internal Revenue Service. Available here

2. 'IRS Head of Household Filing Status.' Efile.com Taxes Made Simple. Available here

The W-4 form tells the employer the amount of tax to withhold from an employee's paycheck based on their marital status, number of allowances and dependents, and other factors. The W-4 is also. This is because single and married filing jointly taxpayers are subject to different tax brackets. However, the range of income that each bracket covers is different for single and married taxpayers. For example, the 10-percent tax bracket for married taxpayers covers a larger amount of taxable income than for single taxpayers. Highlights - Austin is 0% more densely populated than Dallas. People are 2.9% less likely to be married in Austin. The Median Age is 0.2 years older in Austin.

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. The TCJA has kept this rule in place, but raised the exemption amounts to $109,400 if married filing jointly and $54,700 if married filing separately. Single filers have a higher exemption amount.

Online solutions enable you to to organize your file administration and strengthen the efficiency of the workflow. Follow the short manual so that you can fill out IRS irs printable form w4p?, prevent errors and furnish it in a timely way:

How to complete a w 4p 2019?

On the website hosting the blank, choose Start Now and pass for the editor.

Use the clues to fill out the pertinent fields.

Include your individual data and contact details.

Make absolutely sure you enter true data and numbers in proper fields.

Carefully check out the information in the form as well as grammar and spelling.

Refer to Help section should you have any issues or address our Support team.

Put an electronic signature on the irs printable form w4p? printable with the support of Sign Tool.

Once the form is completed, click Done.

Distribute the ready document by way of email or fax, print it out or download on your gadget.

PDF editor makes it possible for you to make alterations towards your irs printable form w4p? Fill Online from any internet linked device, personalize it according to your requirements, sign it electronically and distribute in different means.

The key difference between single and head of household is that for tax purposes, you can qualify as single if you're single (unmarried, divorced, or, legally separated) whereas you can qualify as head of household if you are single, have a qualifying child or relative living with you, and pay more than half the costs of your home.

An IRS tax filing status is a classification that determines many details about a tax return. There are five filing status as single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child. Single and head of household are two of this status for unmarried or single people.

CONTENTS

1. Overview and Key Difference

2. What Does Head of Household Mean

3. What Does Single Mean

4. Similarities Between Single and Head of Household

5. Side by Side Comparison – Single vs Head of Household in Tabular Form

6. Summary

What Does Head of Household Mean?

Head of Household is a tax filing status most people find confusing. However, it is very important to know about this filing status as it offers many benefits. This is a filing status for single or unmarried taxpayers who keep up a home for a ‘Qualifying Person'. To be more specific, you have to meet the following requirements to file as Head of Household.

- You are unmarried or considered unmarried until the last day of the year (this includes single, divorced, or separated people)

- You have paid more than half the cost of keeping up a home for the year.

- A ‘qualifying person' lived with you at home for more than half the year, except for temporary absences.

A qualifying person is generally a dependent that lives with you. For example, an unmarried and unemployed daughter who lives with you can qualify as a ‘qualifying person'. You can use this link to determine whether the relatives who live with you are qualifying persons or not.

Furthermore, if you want to determine whether you have paid for more than half the cost of keeping up a home, the following are some of the expenses you have to take into account:

- Rent

- Mortgage interest

- Insurance payments

- Utility bills

- Food

- Property taxes

- Repairs and maintenance

- Other household expenses

If you meet the above requirements, you can apply as head of household. As mentioned above, this filing status has many benefits. The tax rate for this filing status is usually lower than the rates for single or married filing separately. Furthermore, this status also receives a higher standard deduction than single or married filing separately statuses.

What Does Single Mean?

Single is the filing status for unmarried people who do not qualify for Head of Household status. You can file your status as single if you were unmarried on the last day of the year, and do not qualify for any other filing status.

For tax purposes, a person's marital status for the entire year is determined by his or her marital status at the end of the year, i.e., December 31st. If you are divorced or legally separated by December 31st, then you are considered to be unmarried for the whole year. However, if you are unmarried, but have a dependent child or a qualifying person, you can file status as Head of Household as it has several benefits over the single status.

What is the Similarity Between Single and Head of Household?

- Single and Head of Household are two IRS tax filing status for single people.

Tax Tables Married Vs Single

What is the Difference Between Single and Head of Household?

Single is an IRS tax filing status for unmarried people who do not qualify for another filing status. In contrast, Head of Household is an IRS tax filing status for single people who have a qualifying child or relative living with them, and pay more than half the costs of their home. These definitions explain the key difference between single and head of household.

Furthermore, the major difference between single and head of household is their requirements. Being single on the last day of the year, and not qualifying for any other filing status are the only two requirements for qualifying as single. But, qualifying as head of household has three main requirements: being unmarried or considered unmarried on the last day of the year, paying more than half the cost of keeping up a home for the year, and having a ‘qualifying person' living at home for more than half the year. Furthermore, the head of household status has many benefits over single status. The tax rate for head of household is lower, and the standard deduction rate is higher when compared to single status. Thus, this is another important difference between single and head of household.

Summary – Single vs Head of Household

W 4 Single Vs Married Rate

Single and Head of Household are two IRS tax filing status for single people. The key difference between single and head of household is that Single is a tax filing status for unmarried people who do not qualify for another filing status while Head of Household is an IRS tax filing status for single people who have a qualifying child or relative living with them, and pay more than half the costs of their home.

Reference:

1. 'Publication 501 (2017), Exemptions, Standard Deduction, and Filing Information.' Internal Revenue Service. Available here

2. 'IRS Head of Household Filing Status.' Efile.com Taxes Made Simple. Available here

Image Courtesy:

1.'491626″ by stevepb (CC0) via pixabay

2.'16687016624″ by Pictures of Money(CC BY 2.0) via Flickr